How Lifestyle Benefits Help HR Manage Rising Health Care Costs in 2026

Budgets are tight as we head into 2026, especially when it comes to healthcare. Salary increases are projected to stay flat while employers brace for potential jumps in health insurance premiums and growing demand for caregiving and mental health support. HR and benefits teams are under pressure to meet rising needs without expanding their health plans or adding more vendors.

That’s why many employers are turning to flexible lifestyle benefits as a way to reduce complexity, offset out-of-pocket health-related costs, and broaden support for employees’ overall well-being. Instead of managing separate programs for wellness, caregiving, and professional development, companies are consolidating these needs into streamlined stipends and Lifestyle Spending Accounts (LSAs).

According to Compt’s 2025 Midyear Lifestyle Benefits Benchmark Report, which analyzes the lifestyle benefits programs of Compt customers from January through June 2025, average stipend funding climbed to $1,029 per employee, up more than $170 year over year. Sixty-five percent of customers now offer all-inclusive LSAs, which shows that flexible, consolidated benefits have moved from trend to table stakes.

Here’s what’s shaping 2026 planning and how to design benefits that balance cost-consciousness with genuine care for the people who make your business successful.

Consolidation is the dominant cost-containment strategy.

One theme stands out across the data: efficiency through consolidation. This isn’t about cutting benefits; it’s about cutting complexity. Employers are merging wellness, recognition, family and caregiving support, professional development, and even funds for company swag and branded gear into stipends or an LSA that covers multiple needs with one budget line.

Companies exploring how to consolidate multiple vendors into one perks program are finding measurable returns: fewer contracts to manage, higher employee engagement with the benefit (Compt customers average 93%), and more transparency around total spend.

By combining lifestyle benefits in one streamlined experience with a single vendor, you’re capitalizing on the best cost-optimization strategy that simplifies operations (great for small teams!) and aligns financial stewardship with employee choice.

Wellness benefits are broadening and blending.

Wellness continues to anchor most stipend programs, but the definition has expanded. Thirty-four percent of employers now offer dedicated wellness stipends, and 68% bundle wellness alongside other categories like food, family support, or personal development.

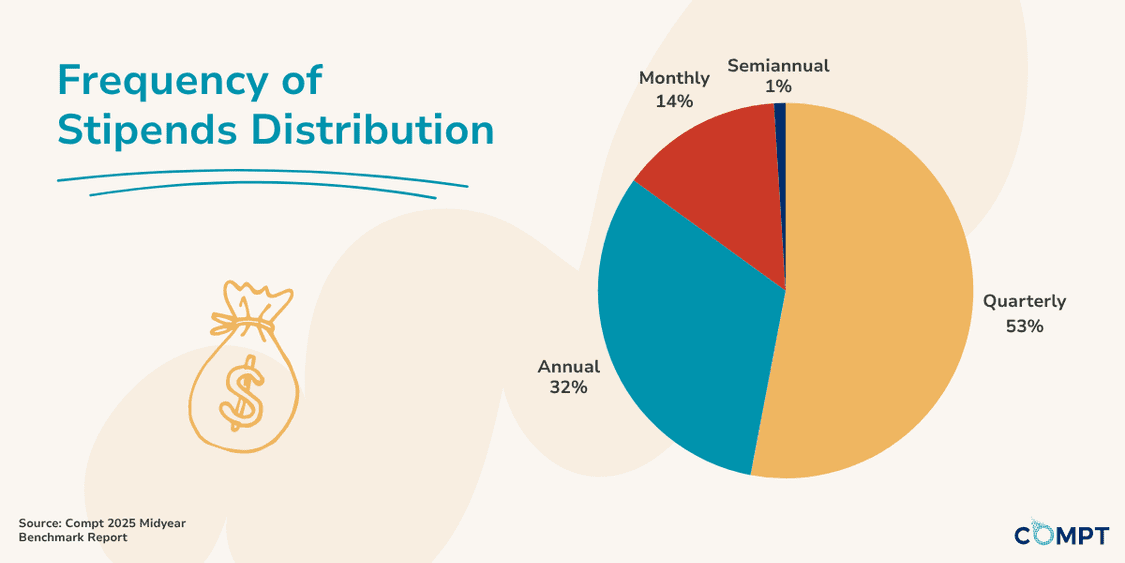

When designing a wellness stipend, flexibility is the foundation. The structure you choose dictates which expenses qualify; eligible expenses can include a wide range of items and services across physical, mental, or even financial wellness (e.g., gym memberships, mental health apps, fitness subscriptions, wearable fitness trackers, groceries, and more). You, the employer, determine qualified expenses as well as both the funding amount and the cadence (monthly, quarterly, semiannual, or annual).

For many employers, these stipends are becoming a practical way to support health-related needs without increasing medical plan costs or adding more vendor contracts.

LSAs complement traditional insurance by helping people cover the everyday costs of well-being. These programs increasingly serve as extensions of health plans; for example, some employers are combining LSAs with Individual Coverage Health Reimbursement Arrangements (ICHRAs) to provide more holistic wellness to their employees. Because wellness stipends are considered taxable benefits, however, employers should account for whether taxes will be passed to employees or grossed up by the company.

The best news? It’s possible to launch a wellness stipend within two weeks and set it up in less than one hour.

Caregiving support is the next major gap to close.

Despite growing demand, caregiving stipends remain rare — they’re offered by only 4% of Compt customers. Yet, caregiving is one of the fastest-rising needs among employees. Forty-five percent of working caregivers adjust their schedules or hours to manage care responsibilities, and without support, many eventually leave the workforce.

The cost of ignoring caregiving is steep. It often results in lost productivity, burnout, and turnover among some of your most experienced employees. For 2026 planning, caregiving goes beyond a compassionate gesture to become a strategic opportunity.

A flexible stipend can fund childcare, elder care, respite services, or memberships to patient-support organizations. When paired with employer-provided health advocacy programs like those offered by Umbra, this approach offers holistic support and helps employees stay focused at work while managing care responsibilities at home.

Here’s how to design lifestyle benefits for 2026.

Designing next year’s program starts with understanding what’s working right now. Compt’s benchmark findings reveal several clear patterns that can guide your approach.

Start with purpose.

Tie each category to an organizational goal: wellness for retention and mental health, professional development for skill growth, caregiving for equity and inclusion. Aim to shift from scattered perks to intentional programs that align with both culture and business outcomes.

Use funding strategically.

Even modest budgets drive value when they’re tied to everyday life. Based on the Midyear Benchmark Report, per-employee annual funding typically ranges from a few hundred dollars for everyday categories to several thousand for high-impact programs: about $180-$3,000 for wellness, $240-$8,000 for professional development, and up to $5,000 for caregiving. These figures represent the full-year amount per employee, not a single payout. And many employers fund on a quarterly cadence to spread costs evenly across the year.

Funding patterns also vary by company size. Smaller employers (<100 employees) invest the most per person, averaging $1,716 annually, compared with $1,391 at midsize organizations and $740 at large enterprises. This doesn’t mean larger companies value stipends less; rather, it reflects how smaller teams often use them as a differentiator when total rewards budgets are leaner.

Regardless of size, every employer benefits from consolidating multiple line items into one well-designed, flexible perk that employees use and enjoy.

Set the right cadence.

Quarterly stipends (53% of programs) remain the sweet spot for recurring needs like wellness or food, and Compt customers appreciate the administrative consistency they provide. Annual funding (32%) works best for professional development, including conference passes and AI tools and training. Monthly programs (14%) can cover ongoing costs like phone bills or commuting.

My advice is to align cadence with intent: recurring for lifestyle, annual for growth.

Design for equity and cost of living.

Funding by region varies — from $1,514 per employee in the West to $754 in the Midwest — but every region increased spending in 2025. The drive toward more personal, consolidated, holistic, choice-driven benefits is playing out differently in each geography, but it’s happening everywhere.

A consistent baseline stipend, adjusted for high-cost areas or competitive markets, helps create fairness without overcomplicating budgets.

Balance taxable and nontaxable categories.

We mentioned above that wellness stipends are taxable, and that’s not uncommon: roughly 78% of stipend spending is taxable.

Pairing nontaxable categories (like professional development or commuter support), which are often viewed as more cost-effective, with taxable ones (e.g., wellness, food, caregiving) stretches your budget further and gives your people plenty of options. You might use taxable stipends to drive program engagement in high-interest categories while leaning on nontaxable ones to provide long-term support without adding tax-related costs to your budget.

When you partner with Compt, which automatically classifies spend by category and was built with IRS compliance as a priority, the taxation of lifestyle benefits becomes one less thing you have to worry about.

Simplify through consolidation.

The question for 2026 isn’t “What new perk should we add?” but “Which line items can we combine into stipends?” This approach strengthens participation, reduces admin time, and ensures employees can use benefits in the ways that matter most to them.

You won’t be alone in taking this approach: 75% of companies have recently invested in improving the overall employee experience. Reporting from The C.O.R.E. Group shows that while only about one in five small businesses currently bundle their non-core benefits under one provider, nearly half of the rest say they find bundling highly appealing.

Across industries and company sizes, leaders are cutting redundant tools and consolidating their stacks to save money and eliminate underused licenses. This suggests they are recalibrating by focusing on benefits that make a real difference in employees’ lives.

Personalized lifestyle benefits show employees they matter.

Across every data point, benefits that feel personal consistently outperform those that don’t. When budgets are tight, consolidation and personalization — not expansion — are what deliver the biggest impact. That’s how HR and benefits teams can balance financial discipline with meaningful employee support heading into 2026.

For more benchmarking insights and examples of flexible stipend design, sign up to receive Compt’s 2026 Annual Lifestyle Benefits Benchmark Report, or request a demo with a Compt benefits expert.

For other caregiving tips for Human Resource leaders, read Umbra’s Caregiving Resource Guide for Employers.

This article was written by Jess Huckins, who leads content strategy at Compt — the #1 platform for personalized employee benefits such as stipends and Lifestyle Spending Accounts. Her work helps HR and benefits leaders design flexible, tax-compliant programs that put people first while keeping administration effortless. Connect with Jess on LinkedIn.